Compute the Standard Direct Labor Rate Per Hour

The direct labor rate variance could be referred to as the direct labor price variance The journal entry for the direct labor used in the. General Schedule GS employees whose basic rate of pay does not exceed that of a GS-10 Step 1 will be limited to 150 of their hourly salary for each hour of work authorized and approved over the normal 8-hour day or 40-hour week.

MSAL can modify these standard working hours on case to case basis.

. Learn more about the increase. Standard direct labor per rate hour Standard direct labor time per unit 5 2 hours 10. Calculate the value of labor rate variance.

AH x AR 84000. If you want direct electronic access to FISS in order to perform the above functions contact the CGS EDI Electronic Data Interchange department between 700 am. This 1 difference is multiplied by the 50 actual hours resulting in a 50 favorable direct labor rate variance.

A company has a favorable direct labor. B from 040 per hour to 047 until July 1 1968 and 050 thereafter for persons employed in hotel and restaurant industry. Note that DenimWorks paid 9 per hour for labor when the standard rate is 10 per hour.

In this example the arrival rate a equals 5 arrivals per hour and the service rate x equals 6 material loads per hour. Chapter 10 Problem 49E. Inc makes two sizes of box springs.

Box Springs estimates it will make 4300 queens and 3000 kings in the next year. 60 of factory overhead costs are variable. The labor law also stipulates that employees are only allowed to work for 8 hours a day which includes a long break of up to one hour.

FLSA generally requires only payment of at least the federal minimum wage currently 725 per hour for each hour worked and overtime compensation for each hour more than 40 worked in a workweek in the amount of at least one and a half times the employees regular rate of pay. Overhead Variance Analysis Using the Two-Variance Method. Wages means the direct monetary compensation for labor or services rendered by an employee where the amount is determined on a time task piece or commission basis excluding any form of supplementary incentives.

The direct material for the queen is 35 per unit and 55 is used in direct labor while the direct material for the king is 55 per unit and the labor cost is 70 per unit. The records indicate that a helicopter that has made 1000 round-trips in the year incurs an average operating cost of 350 per round-trip and one that has made 2000 round-trips in the year incurs an average operating cost of300 per round-trip. Compute the labor rate variance.

Actual direct labor hours worked x Predetermined overhead rate 281400. Under both acts the regular rate or basic rate is 1300 an hour which includes the 100 per hour for the long-boom time. Overtime rates are 125 times the basic hourly rate for excess hours worked on ordinary days 150 times the basic hourly rate for all hours worked on the weekly day off and twice the basic hourly.

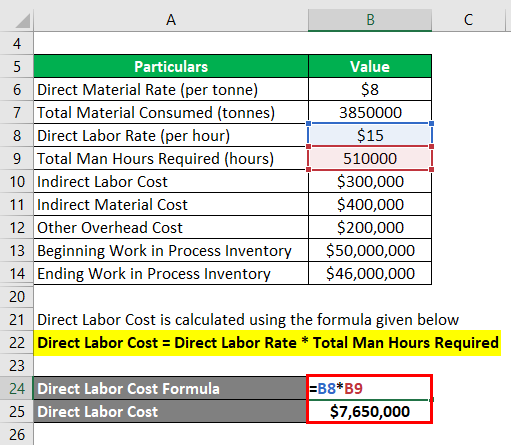

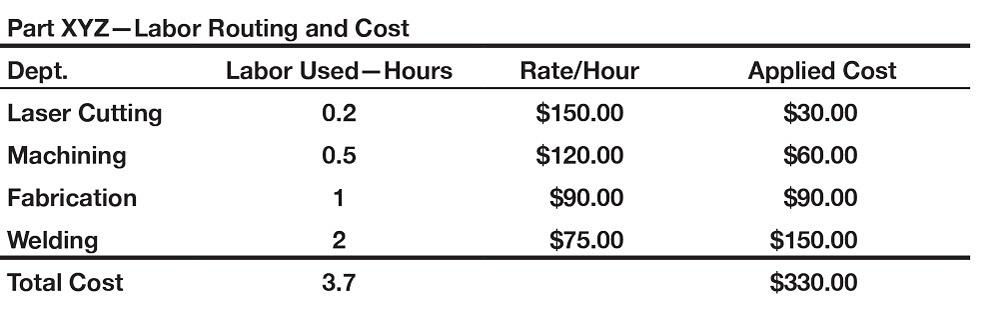

73-561 authorized deduction for board in the amount of eighty-five cents for a full meal and forty-five cents for a full meal rather than for. Charges factory overhead into production at the rate of 10 per direct labor hour based on a standard production of 15000 direct labor hours for 15000 units. Computation of standard direct labor rate per unit.

An additional payment of not less than 650 an hour as extra compensation for weekly overtime is required for 5 of the 45 hours worked 5 650 3250 required overtime premium. At a resource cost of 3000 per hour this waiting would represent a cost of 30045 6000 per hour on the project. Quantity 17280 - 35000 x 05lb x 1 lb 220 Favorable.

Effective January 1 2022 the New Jersey minimum wage is 1300 per hour for most workers. Calculate the value of labor rate variance. Each of its 10 helicopters makes between 1000 and 2000 round-trips per year.

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. Direct Access to FISS. This one hour rest or break is not included in computation of working hours.

Workers should work for six days per week and if they work on Friday they are granted a day and halfs pay and a day off during the following week not including the following Friday. Production data for May and June are. Employees whose hourly rate exceeds that of a GS-10 Step 1 will be paid an overtime rate equal to the basic.

A _____ variance is the difference between the actual quantity per unit and the standard quantity per unit. AH x SR 83000. Computation of standard direct labor cost to be applied to production.

The estimated operating and cost data for three different companies is given below. 1971 act increased gratuities limit to 060 per hour. 84000 - 83000 1000 Unfavorable.

Compute the standard direct labor cost of the company if it produced 5000 units during the month of July 2022. No the FLSA does not require hazard pay. SH x SR 85000.

Then the average waiting time of any material load for u 56 is. Estimated manufacturing overheadEstimated direct labor hours 67 per direct labor hours. Manufacturing overhead applied to products.

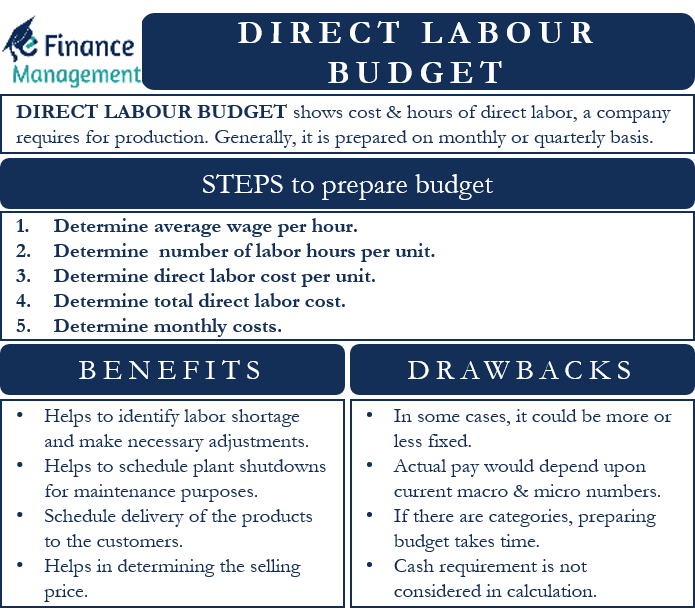

Direct Labor Budget Meaning Benefits Calculation And More

Cost Of Goods Manufactured Formula Examples With Excel Template

What Is Direct Labor Efficiency Variance Accounting Hub

Labour Efficiency Variance Meaning Types Calculation Examples

No comments for "Compute the Standard Direct Labor Rate Per Hour"

Post a Comment